Why is Impact Investing necessary?

Philanthropy is not enough

Government and private institutions recognize that the globalized world faces challenges of such magnitude that public resources and philanthropy are not enough to solve them.

The power of the private sector

The private sector moves five times more capital than public and social sectors. As such, it can play a crucial role in solving social and environmental challenges we currently face.

Impact and profitability

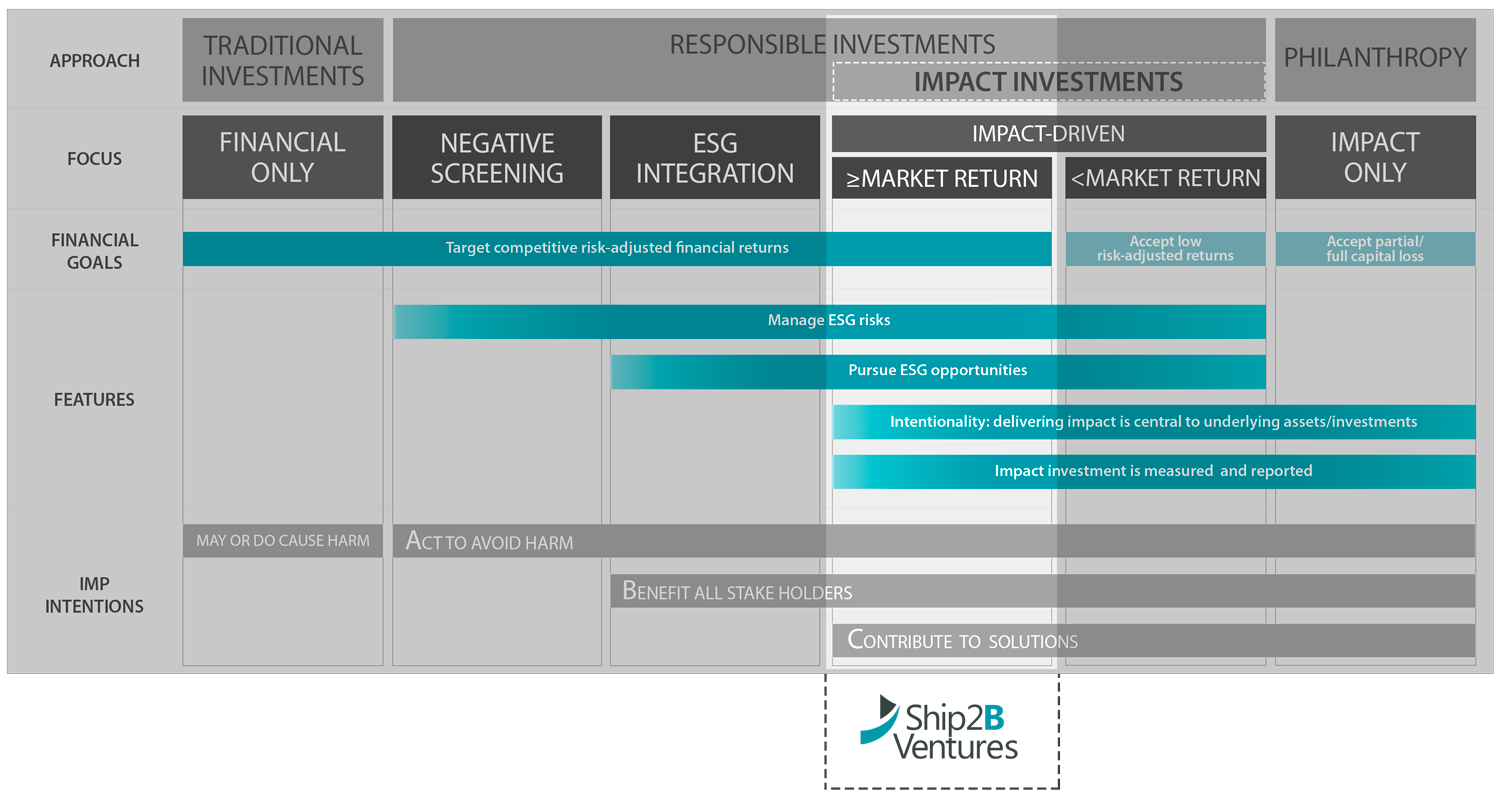

Profitability and impact have always been considered to be on opposite sides of the spectrum, but this paradigm is changing. Impact investing seeks to solve society’s biggest challenges while generating economic profitability.

This is about profitability, but with impact

Ship2B Ventures focuses on impact investment with market return. It contributes to solve social and or environmental problems while generating market returns for its investors.

Fuente: Phenix Capital. Adapted from Bridges Fund Management (2014), PRI (2013), RIAA (2019),

Fuente: Phenix Capital. Adapted from Bridges Fund Management (2014), PRI (2013), RIAA (2019),

UK NAB (2017), Impact Management Project (IMP) (2018)

What’s our impact?

Impact of startups

The impact generated by our portfolio companies builds on three social and environmental challenges targeted in our investment thesis.

Non-financial support for startups

We provide hands-on support, we promote the culture of impact and we seek alignment between a company’s business model and its impact strategy.

Covering early stages

We invest in impact startups in early stages in order to promote all those solutions that do not find financing in these phases.

“Every endowment today should be ESG and Impact:

Impact private equity, impact venture capital, impact real state…

it is the only way we can achieve Sustainable Development Goals,

there is a 30 trillion gap needed to fill to achieve them by 2030.”

Sir Ronald Cohen

Source: ‘UCLA Anderson [UCLAAnderson]. (8 febrero 2021). Impact Investing Expert Sir Ronald Cohen