As a founder, you know that securing funding is tough. But are you making the most of every investor conversation?

Over the last 4 years, fundraising has become a task that requires full dedication, commitment, and perseverance from founders, and yet it continues to be a very long process with a very low success rate. At Ship2B Ventures, for instance, in 2024 we reviewed around 1300 new opportunities, made 3 investments, and advanced four opportunities towards the late stage of analysis to 2025, totaling a success rate of less than 0.5%. Despite the late-year upticks suggesting a potential stabilization, it still continues to be an investor market.

This is why it is so important to be well prepared and use your cards effectively. Based on our experience talking to many founders, we have compiled five tips to help you maximize your fundraising success. These go beyond the usual tips on knowing your business, your numbers, and who to approach. They are meant to be very specific, actionable, fast to undertake, and will greatly resonate with the investors you will be conversing with.

1. When fundraising for round 1, think about round 2

It is so important to have a well planned roadmap for the round you are raising. Starting from the current development stage, the round should cover the progress to specific milestones that ensure your company gains value. This will ensure that in the next round, you are well positioned to attract additional investment at a higher price.

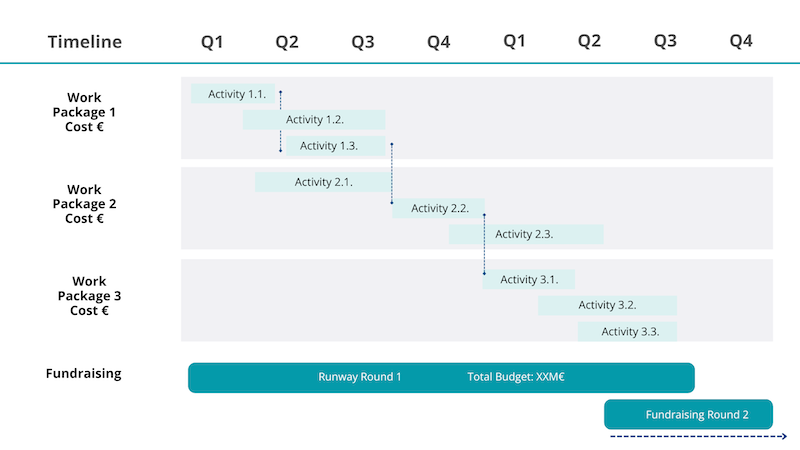

Three parameters should align in a roadmap, and one should clearly expose them at once to demonstrate the plan is well thought out: value inflection points, funding needs, and timeline.

- Value inflection points:

Key events that will result in a significant change in the progress of a company, which can be considered a turning point. One should not confuse development milestones with value inflection points. For example, a value inflection point in biotech is the initial efficacy in the first human trial. Accordingly, rounds that cover IND up to first patient dosed, or demonstrate safety in healthy volunteers, are usually less exciting than those that ensure first efficacy results, as efficacy in patients will increase the price of the company. In medical devices or healthtech, regulatory certification (CE mark or FDA) is often mistaken for a value inflection point. Regulatory certification is key for you to start selling your product, but the key value inflection point here is actual sales that demonstrate that there is a willingness to pay for the solution that you are developing.

- Funding needs:

What will it take, in economic terms but also related to personnel, and/or subcontractors to get to these value inflection points. Point it out clearly, and add some buffer for possible delays and/or deviations.

- Timeline:

How long do you need to reach the value inflection points? Build a realistic plan, and define the runway you need for this round based on that. It is important to consider that the fundraising process can take around 6 months, so keep that into consideration. Roadmaps in which the runway ends at the value inflection point event do not make sense, as you will need to start fundraising 6 months earlier, by when the event is not yet met.

All that should be captured in a simple slide, something like that:

To make this exercise easier, try to always think where you want to be for fundraising the round after the current round. What would the later stage investor like to see for them to be interested? These are the value inflection points. Now work backwards to articulate the plan.

2. Be transparent about your strengths, but mostly about your needs

When meeting with a VC, clearly articulate what makes your project unique, its key strengths, and the competitive advantages it has over existing solutions. Explain the specific need your startup is addressing and provide solid evidence that proves you are on the right track. No doubt you should be highlighting the positives.

However, I’d also recommend being transparent about what you still don’t know or are uncertain about. We are investing in early-stage companies, so uncertainty is our day-to-day. For us, it is more important that you have a plan to clear out the open questions than having no questions on the table. Whether you need an expert opinion, some experiments that are still pending, or are waiting for an FDA meeting to validate your plan, it is key to be upfront and open. This shows us that you are aware of the challenges ahead and have a plan to address them. And this gives us confidence. Also, share your biggest concerns, or if there are some points you are unsure about how to go about. On the one hand, we might be useful. On the other hand (and most importantly), we are already defining the interaction dynamics from the first discussion. Ideally, if we invest in your project, we will be part of the board. A founder/CEO should be completely transparent about the potential questions or issues with her/his board, and showing this attitude in early conversations builds up trust and gives us comfort that we can potentially work together.

3. Get your champion and make use of networks.

You will receive many negatives, no goes or emails saying “unfortunately we decided to stop the analysis”. It is ok. Actually, it is as it should be, based on statistics. So don’t be demotivated, you only need one “yes” to start moving the ball.

If you have that “yes”, congratulations! Now it is time to work together to turn the other “maybes” into positives or open up new options. Ask that lead investor to introduce you to funds or other potential investors, a warm introduction works much better than a cold call.

If you do not yet have that “yes”, look for people motivated by your project, even if they ended up declining. Somebody you had a great discussion with, or that you could see she/he knew the field and asked the appropriate questions. Somebody who was genuinely interested in what you are developing. Sometimes the “no” comes from limitations within the VC (fund timelines, portfolio strategy, etc.), and not because of the opportunity. If there is that interest, ask this person whether she/he knows other investors who might be keen on your project. We usually have recurrent meetings with other VCs to share dealflow and exchange interesting projects that we might or might not be pursuing internally. By doing this, we learn about each other’s investment thesis and current scopes, and thus recommendations are normally better positioned to be considered.

4. Fundraising time is feedback time! Never too early to approach, always a good time to listen.

Having a 1:1 meeting with an investor is prime time, and you must have two objectives in mind. First, you need to be convincing and advance your discussions about potentially working together. Second, and sometimes overlooked, learning, proactively asking questions and getting feedback from the investor.

The second objective is to determine what will make you improve, shape your narrative, and have a higher chance of succeeding in the next conversation. If the investor disagrees with something you are exposing, ask why and try to understand her/his motives open-mindedly. Maybe you were unclear in your explanation, there was an angle you missed, or they are valuing something you did not consider. Take their answers and reflect. Then, decide whether you want to incorporate this piece of advice or not.

It is also important to engage with later stage investors early on. Here, the perspective is not if they want to enter the current round, but rather gathering their general interest, understanding what has to be in place for their consideration, and initiating a long-term conversation. If you address the conversation from this perspective, not only will you get invaluable feedback, but you will also send a positive signal to the investor: you consider their opinion and are willing to take input from others to adapt your plan. This links well with the first advice – start engaging with later-stage investors early, so you can shape your story to what they would like to see at a later (value inflection points). Also, share the content discussions with potential current investors – it shows you are doing your homework and builds confidence in the founder.

5. In the end, it is not about valuation, but it can be a dealbreaker initially.

The last piece of advice covers the topic that most founders are worried about: valuation. We do understand the personal and professional effort it takes to start and run a business and everything that you have committed to. Of course, you have to be rewarded for that and continue to be incentivized.

However, think about the bigger picture. Do you prefer owning 60% of a pie valued at 10M or 35% of a pie valued at 50M? An investment comes with the potential of increasing your company’s value and advancing towards a liquidity event. You are not only giving shares in exchange for money, but also getting strategic advice, previous experience and access to networks that will maximize the chances of actually having a higher return on that stake. A high percentage of something that does not get to a liquidity event has no value.

Having that in mind, try to be fair and understand both sides of the discussion. In the end, the valuation of the company is whatever someone wants to pay for it. Define a valuation range in which you are comfortable, but that can also be justified by reasonable comparables and the stage of the company. For instance, if current revenue multiples for software digital health companies are 4-7x and you have an annual recurrent revenue of 1M, a valuation of 20M is completely out of the range. Also think about the opportunity cost of losing that investor because of a valuation disagreement. Maybe you are losing more than you initially think.

For us, if there is a range we can both be comfortable with, the final investment decision will not solely be based on valuation (it shouldn’t be from any side). However, when we encounter founders who, in the first call, set very unrealistic expectations, we wonder if we will ever get to that common range, which can be an early reason for not continuing our company analysis.